3.5 interest rate mortgage calculator

View estimated house payments on 30-year fixed and other popular loan terms. Build home equity much faster.

Illinois Fha Loan Calculator Fha Loans Loan Calculator Fha

This provides a ballpark estimate of the required minimum.

. Mortgage Credit Certificate MCC Calculator This calculator provides an example of the potential financial impact of having an MCC from the Pennsylvania Housing Finance Agency. You can add an additional amount on top of your monthly payment. Factors that impact affordability.

When you make a 20 down the large payment reduces your loan-to-value ratio LTV. But you may not need that much. Contact your lender to make sure the extra payment is applied to the principal rather than the interest.

Annual Percentage Rate APR The cost to borrow money expressed as a yearly percentage. Use our mortgage payment calculator to see how much your monthly payment could be. Mortgage points or discount points are a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payment.

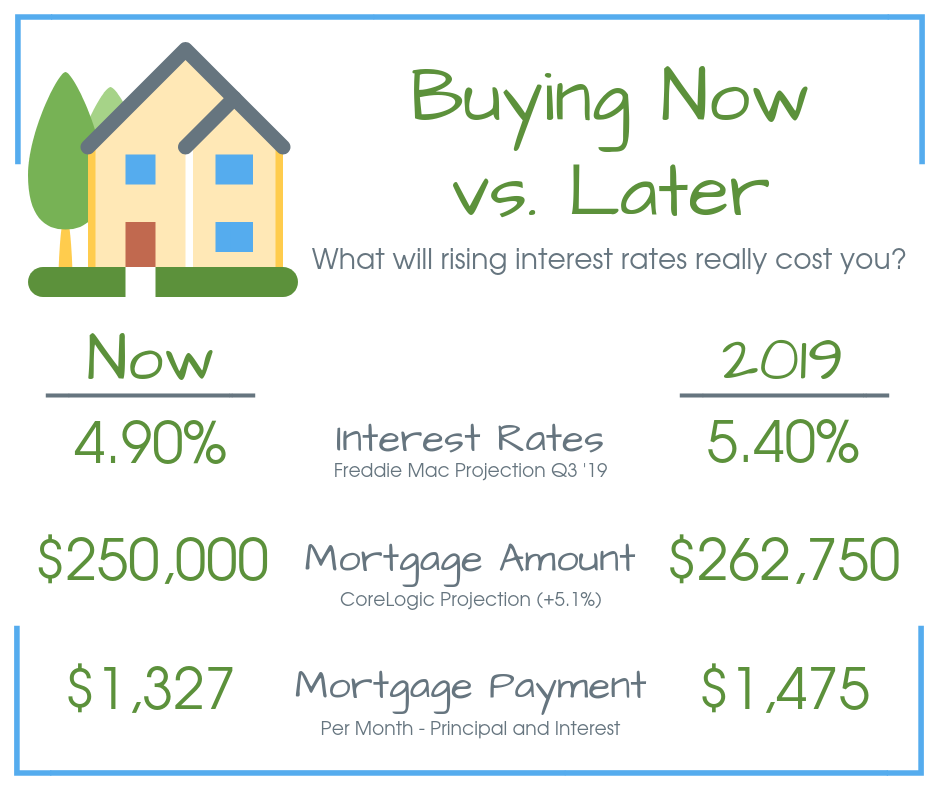

A down payment of 20 or more helps you get a lower interest rate and avoid paying private mortgage insurance. That could change after the Federal Reserve raises its interest rate as. For mortgage loans excluding home equity lines of credit it includes the interest rate plus other charges or fees.

How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment. Bankrates mortgage amortization calculator shows how even a 01 percent difference on your rate can translate to. Small commercial mortgages will usually have a higher interest rate.

See a breakdown of your monthly and total costs including taxes insurance and PMI. In this example a 1 mortgage rate difference results in a monthly payment thats close to 100 higher. The larger the loan then generally this may mean a lower interest rate.

When it comes to calculating affordability your income debts and down payment are primary factors. LTV ratio measures the value of your loan compared to the value of the property securing your loan. And just think if you lived in the 1980s when the highest mortgage rate was 18 youd be paying thousands a month just in interest.

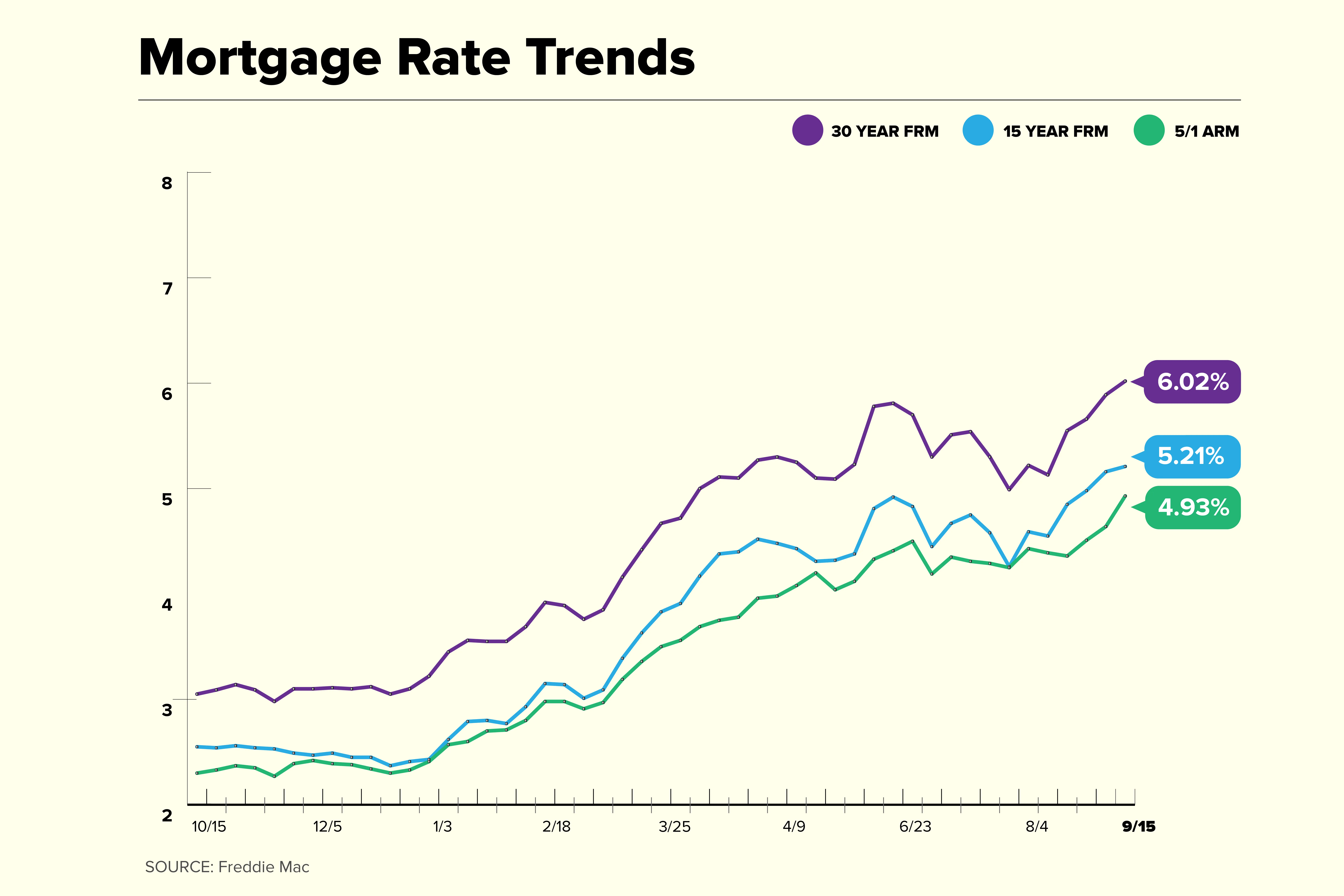

This is because of the costs of running the mortgage account a higher interest rate maybe required on a small facility in order to cover the costs involved and for the lender to make a profit. The average interest rate for a 30-year mortgage has climbed above 6 a level unseen since 2008 reaching 612 this week. If a person.

While both loan types have similar interest rate profiles the 20-year loan typically offers a slightly lower rate to the 30-year loan. Given that ARM loans are variable the interest rate could end up being higher than with a 30-year fixed rate mortgage that has a locked-in mortgage rate. Downpayment For comparison purposes the calculator allows four common choices of 35 5 10 and 15 down.

Here are some of the advantages of a 20-year mortgage over a 30-year mortgage. A 15-year fixed rate mortgage on the other hand may offer a lower interest rate that wont fluctuate like an ARM loan but requires a higher monthly payment compared to a 30-year fixed. While your personal savings goals or spending habits can impact your.

A fixed-rate mortgage has an interest rate that doesnt change over the. The 30-year fixed-rate mortgage is 24 basis points higher than one week ago and 335 basis points higher than one year. Before applying for a mortgage you can use our calculator above.

To learn what the potential benefit might be please enter the information requested below and select the Calculate button to obtain your estimated monthly tax savings. The interest rate is the main factor used by the mortgage payment calculator to determine what your monthly payment and costs will be over time. Decreases your interest rate.

Interest Rate Price 6375 0375 625 000 6125 025 600 050 5875 100 575 175 Each interest rate listed above has a corresponding price which is simply displayed as a percentage of the loan amount. 30-Year Fixed Rate Mortgage. This strategy is convenient for homeowners who want to make one simple payment each month.

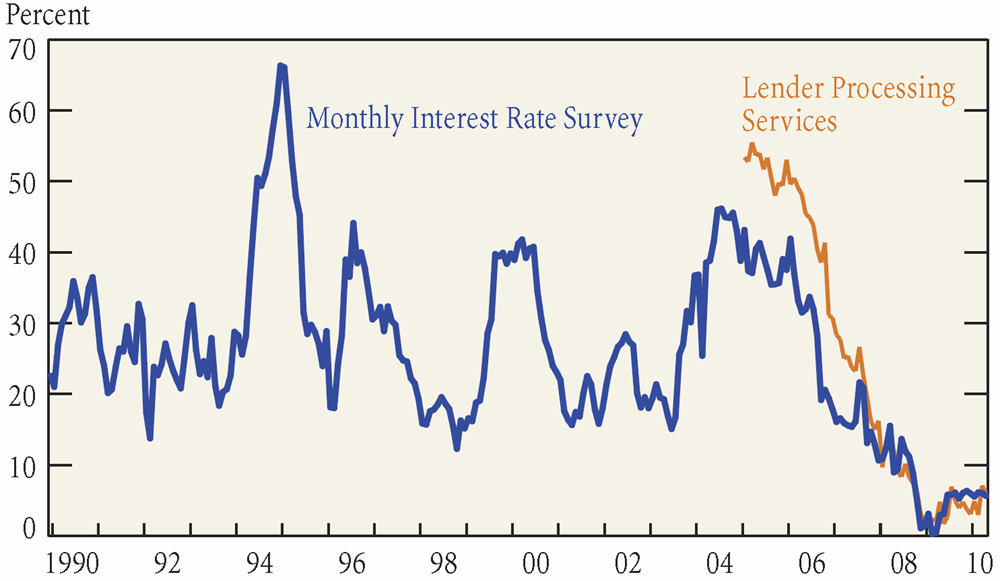

People typically move homes or refinance about every 5 to 7 years. But the real difference is how much more youll pay in interest over 30 yearsmore than 33000. Use our free monthly payment calculator to find out your monthly mortgage payment.

A mortgage rate sheet may look something like this. One mortgage point is equal to about 1 of your total loan amount so on a.

2017 Fha Loan Guidelines How To Qualify For An Fha Loan Fha Loans Mortgage Loans Usda Loan

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Fha 203k Rehab Loan Home Improvement Loans Home Buying Home Improvement

Agbo5fvxuoyi1m

Conventional Mortgage Calculator What Is A Conventional Home Loan Prequalify Calculate Your Monthly Payments Today

Home Loan Approval Process Infographic Dwellaware San Diego Mortgage Home Buying Home Ownership Home Loans

Pin By Jeff Cayton R3homegroup Real On R3homegroup Online Marketing Strategies Home Buying Mortgage Payment

Mortgage Calculator Money

:max_bytes(150000):strip_icc()/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Home Buying 101 Today S Mortgage Rates And What They Mean For You Highland Homes

How To Create An Auto Loan Car Payment Calculator In Wordpress Car Payment Calculator Car Loans Amortization Schedule

Thinking About Buying Now Is The Time 30 Year Fixed Rates Are At A Whopping 3 5 Here Is A Great Visual O 30 Year Mortgage Mortgage Mortgage Interest Rates

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Monthly Amortization Schedule Excel Download This Mortgage Amortization Calculator Template A Amortization Schedule Mortgage Amortization Calculator Mortgage

What Is A 15 Year Fixed Rate Mortgage Fixed Rate Mortgage Refinance Mortgage Mortgage

Interest Only Arm Calculator Estimate 2 1 3 1 5 1 7 1 10 1 Io Monthly Mortgage Payments

Fha Loan With 3 5 Down Vs Conventional 97 With 3 Down Fha Loans Mortgage Approval Current Mortgage Rates